Australia's central bank holds rates, softens hawkish stance slightly

Australia’s central bank on Tuesday reiterated that interest rate cuts were unlikely in the near term as it held policy steady, but softened its hawkish stance by saying monetary tightening was not discussed.

Governor Michele Bullock said the board did not actively consider raising rates but did discuss whether or not its hawkish messaging should change.

The Australian dollar hit a nine-month high of $0.6869 but later retreated to $0.6820 on comments from Bullock. Futures edged higher as markets priced in a slightly more chance of 72% for a rate cut by the end of the year.

Wrapping up its September policy meeting, the Reserve Bank of Australia (RBA) kept rates at a 12-year high of 4.35% and reiterated policy would have to be sufficiently restrictive to ensure inflation returned to target.

"While headline inflation will decline for a time, underlying inflation is more indicative of inflation momentum, and it remains too high," the board said in a statement largely similar to the one in August.

"Policy will need to be sufficiently restrictive until the Board is confident that inflation is moving sustainably towards the target range."

Markets had wagered heavily on a steady outcome given underlying inflation remained sticky and the labour market held up surprisingly well.

Bullock, in her post-meeting press conference, said the board did not "explicitly" consider a rate hike at this meeting.

"The board did discuss whether or not the messaging should change,.... having said that, the message clearly from the board is that in the near term, it does not see interest rate cuts," the RBA chief said.

The central bank has kept rates steady since November, judging that the cash rate of 4.35% - up from a record-low 0.1% during the pandemic - is restrictive enough to bring inflation to its target band of 2-3% while preserving employment gains.

With underlying inflation stubborn at 3.9% last quarter and the labour market churning out lots of new jobs, there appears to be no urgency to ease policy like what the Federal Reserve did last week, cutting by 50 basis points to preempt sharp job losses.

The RBA already trails other central bank in cutting rates, and the political pressure is ramping up for an easing. The left-wing Greens on Monday demanded the government to engineer a cut in interest rates in exchange for their support in parliament to pass the long-delayed reforms to the RBA.

"While the RBA did not explicitly consider a rate hike because not enough had changed since the last meeting, its language continues to lean mildly hawkish," said Shane Oliver, chief economist at AMP.

"We see rates as having peaked, with the first cut coming in February next year. However, despite RBA guidance, a rate cut is still possible by year end if unemployment rises more sharply and underlying inflation falls more sharply."

Market sentiment in Australia on Tuesday was aided by more stimulus from China's central bank, which announced cuts to reserve requirements and lending rates, including for existing home loans.

Investors are now waiting for the monthly inflation data for August on Wednesday. Headline inflation is likely to have slowed to an annual rate of 2.7% thanks to the government's electricity rebates, but the core gauge could once again highlight sticky prices.

"If tomorrow we get an inflation number which has got a two in front of it, so it's back in the band, that doesn't mean we've got inflation under control," Bullock said, signalling to markets that the RBA won't be in a hurry to ease policy.

"It doesn't mean that inflation is sustainabily back within the band."

Most Read News

-

Russia, Ukraine accuse each other of overnight airstrike

Russia, Ukraine accuse each other of overnight airstrike

-

Israeli prime minister departs for US to meet Trump

Israeli prime minister departs for US to meet Trump

-

1st phase of Myanmar elections concludes

1st phase of Myanmar elections concludes

-

Syria announces arrest of ‘terrorist cell’ member in Lat

Syria announces arrest of ‘terrorist cell’ member in Lat

-

Polish premier condemns Russian strike on Kyiv, urges st

Polish premier condemns Russian strike on Kyiv, urges st

-

Guineans vote in presidential election with coup leader

Guineans vote in presidential election with coup leader

-

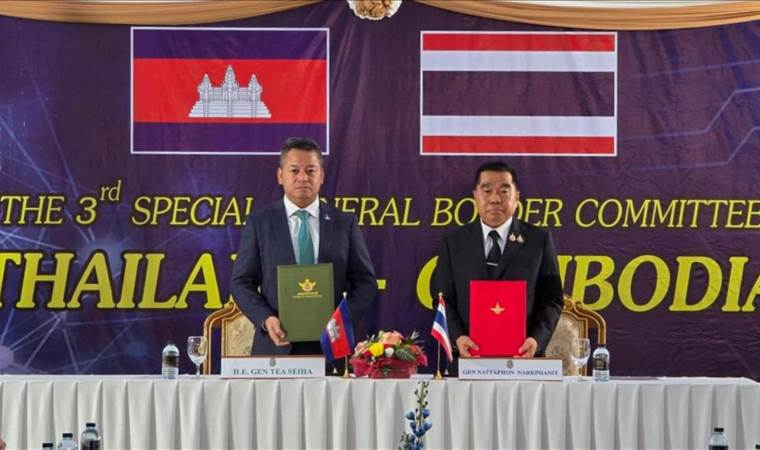

Cambodia-Thailand border calm for 2nd day following ceas

Cambodia-Thailand border calm for 2nd day following ceas

-

Illegal Israeli settlers damage Palestinian properties i

Illegal Israeli settlers damage Palestinian properties i