New Bitcoin ETFs attract $2 billion in 3 days

A recent launch of U.S. bitcoin exchange-traded funds (ETFs) has seen a surge in investor interest, drawing $1.9 billion across nine new funds in just three days.

This influx outperformed the initial days of the ProShares Bitcoin Strategy ETF, which attracted $1.2 billion in 2021. However, these investments in the ETFs, approved by the U.S. Securities and Exchange Commission on January 10, did not meet the most ambitious forecasts of billion-dollar inflows on the first day.

The interest in these ETFs, which track the spot price of bitcoin, is a significant indicator of the growing mainstream acceptance of cryptocurrency. Despite Bitcoin's 8% decline since January 11, market analysts remain optimistic. They suggest potential inflows could reach $50 billion to $100 billion by year-end, though the cryptocurrency's volatility continues to pose a challenge.

Leading the charge in attracting investments are BlackRock's iShares Bitcoin Trust ETF and Fidelity’s Wise Origin Bitcoin Fund, with over $700 million and $500 million, respectively. Fees among these ETFs vary, with BlackRock and Fidelity offering competitive rates compared to the average ETF fee of 0.54%. Experts like Sui Chung, CEO of CF Benchmarks, believe lower fees and brand recognition are key to their success.

Contrasting with this trend is the Grayscale Bitcoin Trust, which has experienced significant outflows since its conversion into an ETF, coinciding with the new launches. Grayscale CEO Michael Sonnenshein defends the firm’s fees, citing its track record and substantial assets under management.

Looking ahead, the challenge for these bitcoin ETFs is to maintain investor interest and extend their appeal to institutional investors. According to Steve Kurz of Galaxy Digital, the integration of these ETFs into broader investment portfolios and their long-term viability in the market will become clearer in the coming months.

Most Read News

-

ISIS mission in Iraq

ISIS mission in Iraq

-

‘Engagement builds trust,’ UK Prime Minister Starmer urg

‘Engagement builds trust,’ UK Prime Minister Starmer urg

-

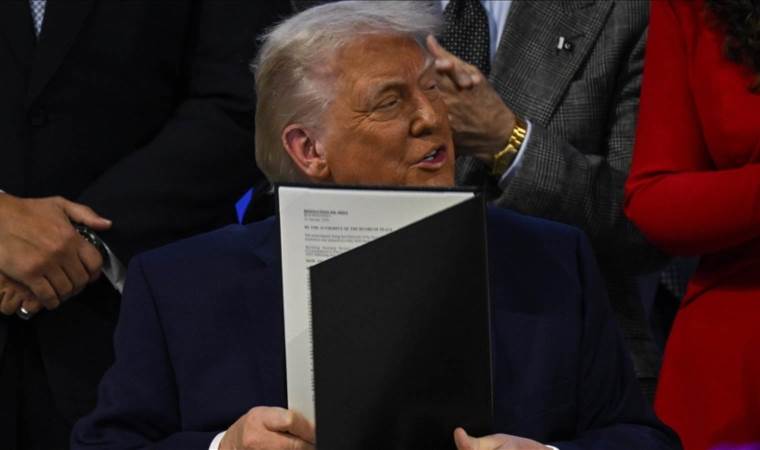

Trump says he is not pulling ICE agents out of Minnesota

Trump says he is not pulling ICE agents out of Minnesota

-

US envoy hails Syria-YPG integration deal as ‘historic m

US envoy hails Syria-YPG integration deal as ‘historic m

-

Trump weighs Iran strike as intelligence flags no immedi

Trump weighs Iran strike as intelligence flags no immedi

-

France's Macron calls for ‘massive’ anti-drug plan targe

France's Macron calls for ‘massive’ anti-drug plan targe

-

US warship prepares to dock in Gulf of Aqaba amid region

US warship prepares to dock in Gulf of Aqaba amid region

-

Protest held in the Netherlands over police violence aga

Protest held in the Netherlands over police violence aga

-

Azerbaijan says it will not allow its territory to be us

Azerbaijan says it will not allow its territory to be us