Bitcoin climbs above $45,000 for first time since April 2022

Bitcoin soared past $45,000 on Tuesday, reaching a level not seen since April 2022. This surge marked a vibrant start to the New Year for the world's leading cryptocurrency, fueled by hopeful anticipation surrounding the potential approval of exchange-traded spot bitcoin funds.

The cryptocurrency achieved a 21-month high, hitting $45,532. This milestone reflects a 156% increase from the previous year, marking its most robust annual performance since 2020. As of the latest reports, Bitcoin had risen by 3.5%, reaching $45,727. However, it still trails its all-time high of $69,000, set in November 2021.

Ether, associated with the Ethereum blockchain network, also saw a rise, increasing 2.6% to $2,414 on Tuesday. This increase builds on its impressive 91% surge in 2023.

In U.S. premarket trading, cryptocurrency-related stocks, which often mirror Bitcoin's price movements, experienced significant gains. Riot Platforms, Marathon Digital, and CleanSpark saw their shares increase by 11.3% to 14.8%, recovering from steep declines in the final days of 2022.

Coinbase, a U.S. crypto exchange, climbed 6.3%, while software company and Bitcoin investor MicroStrategy advanced by 9.4%.

Investor attention is currently focused on whether the U.S. Securities and Exchange Commission (SEC) will approve a spot bitcoin ETF soon. Such an approval could open the market to a broader investor base and attract billions in investment.

Over the years, the SEC has turned down several applications for spot bitcoin ETFs, citing concerns about market manipulation. However, recent developments suggest a growing readiness among regulators to approve some of the 13 proposed spot bitcoin ETFs, with a decision expected in early January.

Chris Weston, head of research at Pepperstone, commented on the potential market reactions to approval or rejection of the ETF. "A rejection would likely trigger an immediate downturn," he said. "Conversely, approval raises the question: will this lead to a 'buy-the-rumor, sell-the-news' scenario or spark a further upward trend?" he added in a note.

Cryptocurrencies have also benefited from increasing expectations that major central banks might cut interest rates this year, helping to dispel the negative sentiment caused by the collapse of FTX and other crypto-business failures in 2022.

Markus Thielen, founder of digital asset research firm 10x Research, noted that crypto markets might continue to gain in 2024. He pointed out that Bitcoin tends to perform well in U.S. election years, as seen during the Bitcoin halving cycles in 2012, 2016, and 2020.

Most Read News

-

Multiple people rescued after floodwaters inundate centr

Multiple people rescued after floodwaters inundate centr

-

Protests continue for 4th day against Israeli president'

Protests continue for 4th day against Israeli president'

-

Madagascar reels from Cyclone Gezani: 36 killed, hundred

Madagascar reels from Cyclone Gezani: 36 killed, hundred

-

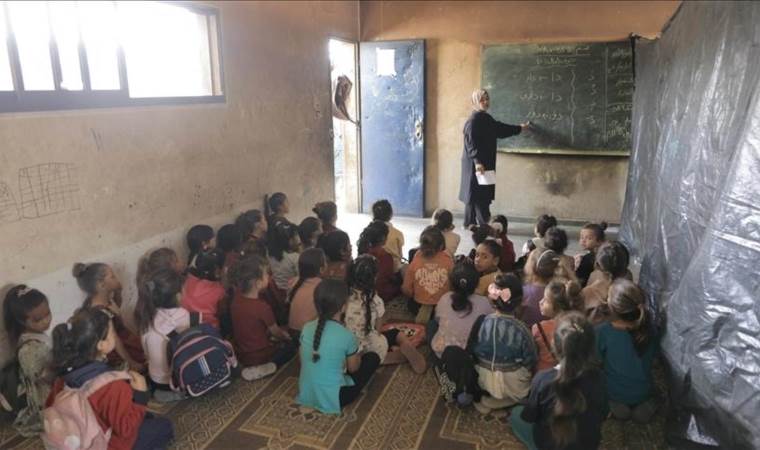

Nearly 90% of Gaza schools damaged or destroyed in Israe

Nearly 90% of Gaza schools damaged or destroyed in Israe

-

Poland loyal ally of US, but ‘will not be a vassal,’ pre

Poland loyal ally of US, but ‘will not be a vassal,’ pre

-

Israeli forces stage new raid into Syria’s Quneitra coun

Israeli forces stage new raid into Syria’s Quneitra coun

-

EU faces 'extremely strong' competition from China, US t

EU faces 'extremely strong' competition from China, US t