Bitcoin approaches record high, surpassing $68,000

Bitcoin reached a two-year peak on Tuesday, soaring past $68,600 and inching close to its all-time high, fueled by a significant influx of investment into the world's leading cryptocurrency by market value.

With a 50% gain this year, the surge has been particularly notable in recent weeks, coinciding with a spike in inflows to U.S.-listed bitcoin funds. In Asian trading hours on Tuesday, Bitcoin hit a session high of $68,828, just shy of its November 2021 record of $68,999.99.

The approval of spot bitcoin exchange-traded funds (ETFs) in the United States earlier this year has attracted large investors, reigniting the enthusiasm that drove Bitcoin to record levels in 2021. "We're witnessing crypto mania 4.0, driven by low volatility in bonds and rates. The market is showing signs of irrational behavior," Kyle Rodda, a senior market analyst at Capital.com, observed.

Investments in the ten largest U.S. spot bitcoin funds totaled $2.17 billion in the week ending March 1, with BlackRock's iShares Bitcoin Trust capturing over half of these inflows, as per LSEG data. "The fervor for Bitcoin exposure is reaching unprecedented levels," noted Tony Sycamore, an analyst at IG, suggesting that while Bitcoin may seem overbought in the short term, the rally isn't over, and a move towards $80,000 is plausible.

This rally coincides with record-breaking performances in global stock indexes such as Japan's Nikkei, the S&P 500, and the Nasdaq, while volatility indexes in equities and foreign exchange have seen declines. Ether, Bitcoin's smaller counterpart, has also surged over 50% this year, partly on speculation about potential ETF-driven inflows, last trading around $3,649.

Regulatory developments continue to unfold, with the U.S. Securities and Exchange Commission delaying its decision on BlackRock's application for a spot Ethereum ETF. Meanwhile, Tether announced that the issuance of its dollar-pegged stablecoins has surpassed $100 billion, highlighting the growing acceptance and use of stablecoins in the cryptocurrency market.

Most Read News

-

Multiple people rescued after floodwaters inundate centr

Multiple people rescued after floodwaters inundate centr

-

Protests continue for 4th day against Israeli president'

Protests continue for 4th day against Israeli president'

-

Madagascar reels from Cyclone Gezani: 36 killed, hundred

Madagascar reels from Cyclone Gezani: 36 killed, hundred

-

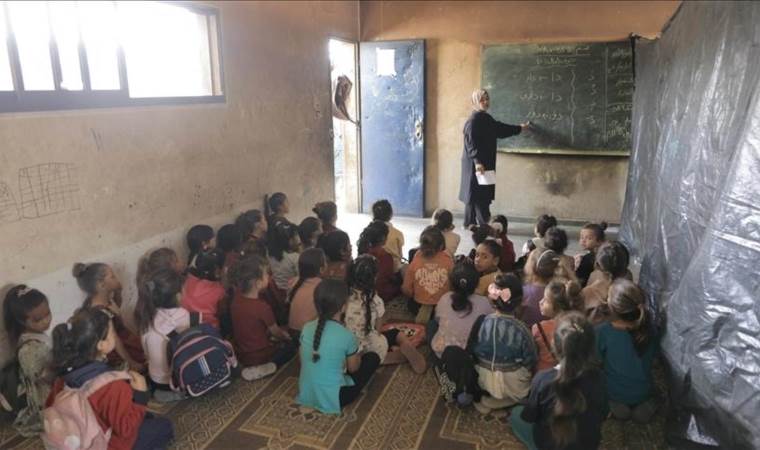

Nearly 90% of Gaza schools damaged or destroyed in Israe

Nearly 90% of Gaza schools damaged or destroyed in Israe

-

EU faces 'extremely strong' competition from China, US t

EU faces 'extremely strong' competition from China, US t

-

Poland loyal ally of US, but ‘will not be a vassal,’ pre

Poland loyal ally of US, but ‘will not be a vassal,’ pre

-

Israeli forces stage new raid into Syria’s Quneitra coun

Israeli forces stage new raid into Syria’s Quneitra coun