Turkey working to ease banks' capital strains amid lira crash - sources

Turkey's authorities are working on possible relief measures for banks caught between a currency crash and existing capital requirements, including a potential capital injection for state banks, according to three sources familiar with discussions.

The Banking Regulation and Supervision Agency (BDDK) is considering adding more flexibility around the capital adequacy ratio (CAR), which is high relative to global peers at 12%, said two banking sources close to the matter.

For public lenders - which analysts say face the most stress - a planned capital infusion should ease CAR pressure, though it was unclear how much would be needed given the rapid currency sell-off, said a banker and a senior economy official. read more

The BDDK's plan is not finalised, the sources said, requesting anonymity.

The BDDK and Ministry of Finance were not immediately available to comment. Ziraat Bank declined to comment, while the other two big state lenders - Vakif Bank (VAKBN.IS) and Halk Bank (HALKB.IS) - were not immediately available.

Most Read News

-

ISIS mission in Iraq

ISIS mission in Iraq

-

‘Engagement builds trust,’ UK Prime Minister Starmer urg

‘Engagement builds trust,’ UK Prime Minister Starmer urg

-

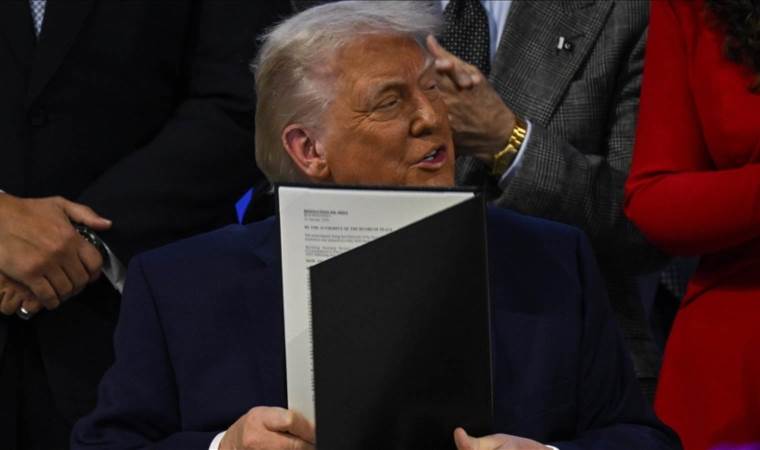

Trump says he is not pulling ICE agents out of Minnesota

Trump says he is not pulling ICE agents out of Minnesota

-

US envoy hails Syria-YPG integration deal as ‘historic m

US envoy hails Syria-YPG integration deal as ‘historic m

-

Trump weighs Iran strike as intelligence flags no immedi

Trump weighs Iran strike as intelligence flags no immedi

-

France's Macron calls for ‘massive’ anti-drug plan targe

France's Macron calls for ‘massive’ anti-drug plan targe

-

US warship prepares to dock in Gulf of Aqaba amid region

US warship prepares to dock in Gulf of Aqaba amid region

-

Protest held in the Netherlands over police violence aga

Protest held in the Netherlands over police violence aga

-

Azerbaijan says it will not allow its territory to be us

Azerbaijan says it will not allow its territory to be us